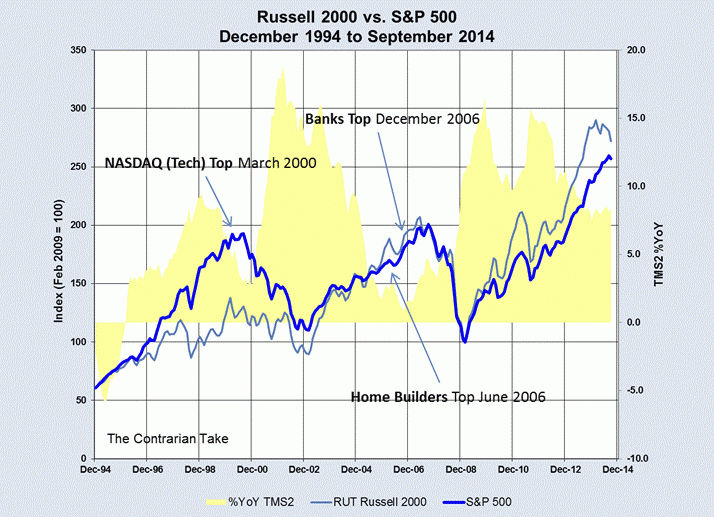

Austrian economist Micheal Pollaro writes that with the end of QE3 coming that stock market bulls need to take a note of caution because the Austrian measure of the money supply is already falling. This is typically a sign of trouble for stock markets.

The Federal Reserve’s latest asset purchase program, QE3, is coming to an end. What was once an $85 billion a month program, one in which at its peak had been goosing the financial markets and economy at an annual rate of $1.0 trillion – and over its 27 month life will have pumped $1.7 trillion of money into the economy – is going to zero. Given the outsized impact QE has had on the growth of U.S. money supply and thus the U.S. economy, we say investors take note, especially those furthest out on the risk curve, because what was once your primary tailwind could soon become your greatest headwind, maybe even a gale force.

Thus, when an economy is subjected to a bout of monetary inflation, investors can enhance their performance by correctly positioning their portfolios on the right side of the boom-bust cycle. Though easier said than done, one should buy claims to the malinvestments of the boom; i.e., when the money supply is surging; then sell those same claims after the growth in the money supply peaks and begins to head down. Importantly, the bigger the bout of monetary inflation, the more important it is to be positioned on the correct side of the boom-bust cycle. The reason is simple – lots of monetary inflation means lots of malinvestments in the economy and financial markets. Indeed, correct positioning is even more important on the downside of the boom-bust cycle. You see, booms tend to develop slowly. Busts, complicated by the distortions created during the boom, more often than not do anything but.

Now you know why we call this current monetary cycle the Bernanke Risk-On Boom – Bust-to-Be! Unlike in past monetary cycles where money was largely injected into the real economy via bank asset purchases and loans, this inflation cycle is all about huge swathes of money being injected directly into the financial markets via Federal Reserve’s QE asset purchase programs. The banking system, at least to this point, has had a minor role.

Unless the Federal Reserve changes its mind, the last installment of QE is ending next month. That means that if the banking system, the other and more traditional source of monetary inflation, does not step up and fill the inflationary void being vacated by the Federal Reserve, the money supply is set to fall, and fall substantially in the coming months.

In other words, bulls take heed – our yellow light could be tuning red.