As 2017’s first FOMC meeting approaches this Tuesday and Wednesday, we will once again wait on the edge of our seats for the insight of the “Experts.” Last year’s fourth quarter GDP blew a massive hole into the recovery narrative, but with Donald Trump promising a major infrastructure spending package and large tax cuts, there seems to be a renewed push toward raising the Fed Funds rate target to counter rising prices.

While the odds of a rate hike at this meeting are low, the first meeting under the new administration may give hints to major 2017 themes. FOMC meeting minutes are usually remarkably bland as the Fed balances the task of communicating “everything is peachy” with “the economy still needs our unprecedented interest rate manipulation.” It’s been this way since 2010. But in case you are wondering, yes, you are still to take them Very Seriously.

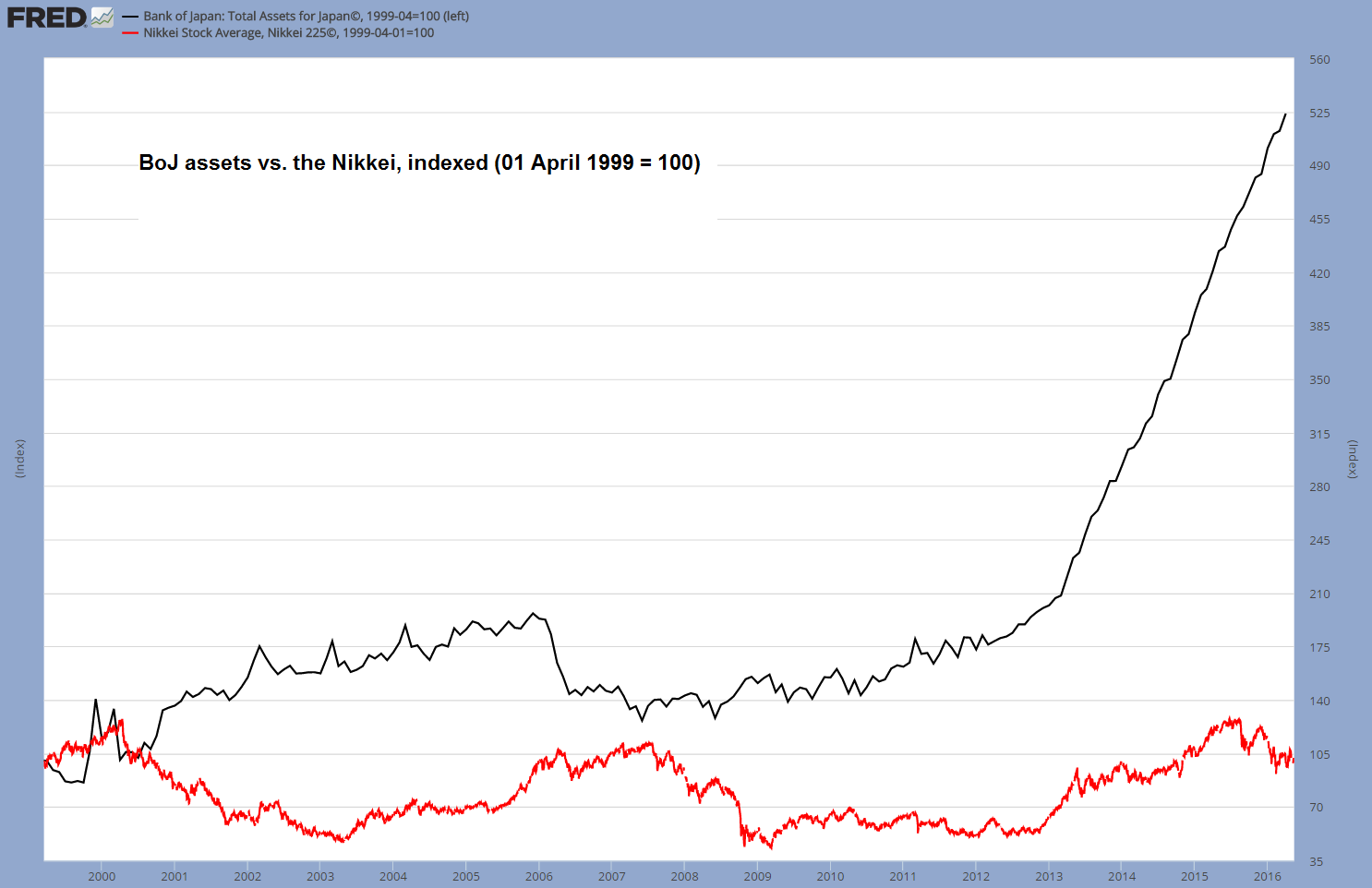

On the other side of the Pacific, the Bank of Japan also meets this week. We can wish the BOJ a happy anniversary as this meeting is the one year mark for official negative interest rate policy. We should all resolutely criticize the ludicrous actions of Bernanke and Yellen, but BOJ governor Haruhiko Kuroda makes those two look like Paul Volcker. The Fed has gone haywire in the purchase of bonds and mortgage backed securities, but to the BOJ that’s just adorable child’s play. The BOJ is now “a top-10 shareholder of 90% of Japan’s stock market.”

The major late 2016 theme for the BOJ has been a “yield curve control policy” in which the BOJ aims to have 10-year Japanese Government Bonds yielding nothing. That’s right: we live in such a bizarro world that it is considered sane and reasonable for over-indebted governments to borrow at no cost for an entire decade. The question of course is how much longer this can continue. Nonetheless, what we expect to see at the meeting this week is both a defense and a continuation of the lunacy.

The BOJ has taken the opposite approach as the Fed in the sense that the former has indicated no sign of truly “tightening.” As the BOJ continues to maintain their loosening monetary policy, this makes it more and more difficult for the Fed to “raise rates” alone. But more will be revealed in this week’s meetings.